If you’re buying a home or refinancing the one you already have, your lender might suddenly say, “We need a loan closing survey.” You hear that and think, Okay… what does that even mean? Then the clock starts ticking. Escrow wants dates. Your rate lock has a deadline. Meanwhile, nobody explains what the survey should cover, who orders it, or why it costs what it costs.

Why lenders bring up a survey at the worst time

A lender wants to protect the loan. That’s it. They don’t want surprises tied to the land that could hurt the home’s value or cause legal problems later. However, many lenders don’t teach the process. They just send a requirement and move on.

Also, people mix up the word “survey.” Some folks mean a property boundary survey. Others mean a sketch used for title work. Sometimes the lender accepts an older survey. Other times they want a current one. Because of that, you can waste days going back and forth unless you ask the right questions early.

What a loan closing survey usually helps confirm

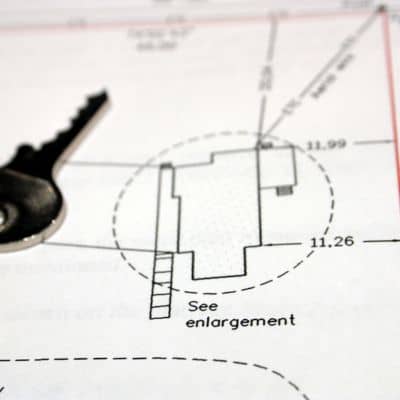

Think of a loan closing survey as a tool that supports closing. It helps confirm key facts about the property, like where improvements sit compared to the lot lines and whether anything obvious crosses where it shouldn’t.

For example, a survey can reveal:

- A fence that sits over the line

- A driveway that crosses onto a neighbor’s parcel

- A garage, wall, or patio that pushes too close to a line

- A recorded easement that runs right through the area you thought you owned

In Los Angeles, those issues pop up more often than people expect. Lots vary in shape. Hillsides add complexity. Older neighborhoods include quirky lot splits, shared driveways, and long-forgotten easements. So even when “everything looks fine,” the paperwork can tell a different story.

What lenders don’t say out loud

Here’s the quiet truth: a lender rarely wants “the perfect survey.” They want the right level of proof for their file. Still, they often won’t define what “right” means unless you push.

So you should ask, early and clearly:

- Do you require a new survey, or will you accept an existing one?

- If you accept an existing one, how recent must it be?

- Do you want property lines shown, or do you only need improvements shown?

- Do you need surveyor certification language for the lender or title company?

Those questions sound simple. However, they can prevent the most common problem: you order the wrong scope, then you pay again to fix it.

The LA twist: you can’t order smart without property info

In LA, the fastest way to lose time involves vague requests like, “How much for a survey?” A good surveyor needs context. Meanwhile, most homeowners don’t know what to send. That’s where the 20-minute pre-survey packet helps. It gives your surveyor what they need to quote and schedule with fewer follow-ups.

Even better, it keeps your closing on track. You reduce surprises, and you avoid scope creep.

The 20-minute pre-survey packet that saves money

You don’t need special software. You don’t need insider access. You just need three items and a short note.

1) Pull your AIN/APN from the LA County Assessor map tools

First, grab your parcel identifier. LA County often uses an AIN and an APN. Either one helps, and both help even more.

Why it matters: addresses can get messy. Units, street suffixes, and lot descriptions don’t always match perfectly. However, parcel IDs point to the exact property in public records. That precision saves time.

2) Pull recorded documents from LA County Recorder resources

Next, gather what you can find from recorded real estate documents, such as:

- Your deed or grant deed

- Any recorded map or tract map reference

- Any easement documents (utility, access, drainage)

- Any lot line adjustment or split paperwork, if it exists

You don’t need to understand every line. Still, those documents tell the surveyor what the county recorded and what restrictions may exist. That makes a big difference in LA.

3) Check zoning and overlays in ZIMAS (if you’re in the City of LA)

Then, if the property sits in the City of Los Angeles, open ZIMAS and pull zoning and overlays.

Why it matters for closing: zoning doesn’t set property lines, but it signals risk. Hillside areas, special overlays, or unusual constraints can affect what you can build, rebuild, or modify. That can influence lender questions, especially when a property has additions or ADUs.

4) Write one short paragraph about your goal

Finally, write a simple scope note. Keep it human.

Try this: “I’m buying/refinancing in Los Angeles. My lender asked for a loan closing survey for closing. The property is a [single-family home/condo/duplex]. Improvements include [fence/retaining wall/driveway/ADU/garage]. Access notes: [gate code, dogs, tenant schedule]. Target closing date: [date].”

That paragraph does two things. First, it tells the surveyor the purpose. Second, it highlights likely trouble spots. As a result, you get a cleaner quote and a better timeline.

Why “paying extra” doesn’t always speed things up

People often ask for rush service. I get it. Closings create stress. However, survey work includes steps you can’t skip:

- Records research takes time, especially with older tracts or complex parcels.

- Field work needs access. Locked gates and tenants can slow everything down.

- Drafting and quality control takes focus, because mistakes cause legal trouble.

So instead of trying to “buy speed,” you should remove friction. The pre-survey packet does exactly that. It reduces phone calls, missing info, and scope confusion.

The most common closing surprises you can avoid

Even in normal neighborhoods, these issues show up a lot:

- Fence lines that “look right” but sit off the boundary

- Shared driveways that cross parcels

- Retaining walls that land partly on a neighbor

- Utility easements that cut across a side yard

- Additions that sit closer to a line than owners realize

None of those problems mean you can’t close. However, they can trigger extra questions and delays. So you want to discover them early, not two days before signing.

What to do next (so you don’t pay twice)

If your lender mentions a survey, don’t panic. Instead, do three things today:

First, ask your lender what they mean by “loan closing survey” and what format they want for the file. That way, you won’t pay for the wrong scope.

Next, pull your pre-survey packet (AIN/APN, recorded docs, and ZIMAS if relevant). It takes about 20 minutes, but it can save days of back-and-forth.

Finally, send that packet in your first message when you request a quote. If you’re buying (not refinancing), tell the surveyor you need a loan closing survey for home purchase and include your target closing date, so they can confirm the right deliverable and timeline right away.

That’s it. You’ll sound prepared, and you’ll move faster.